The global financial market is heavily affected by geopolitical conflicts, while Poland is affected by this movement. Located at the border of Eastern and Western Europe, Poland maintains special sensitivity to international relation changes, given its EU membership. Sentiments within neighboring regions rise when military or diplomatic conflicts, or economic sanctions, emerge, thus affecting investor confidence, together with market performance. The Zloty becomes vulnerable to unexpected price fluctuations when international relations remain uncertain. Being informed about market developments and having the ability to react quickly are essential for Polish traders. Traders use advanced platforms, including MetaTrader 4 platforms, to monitor currency activity while modifying their trading approaches, because unpredictable market shifts occur.

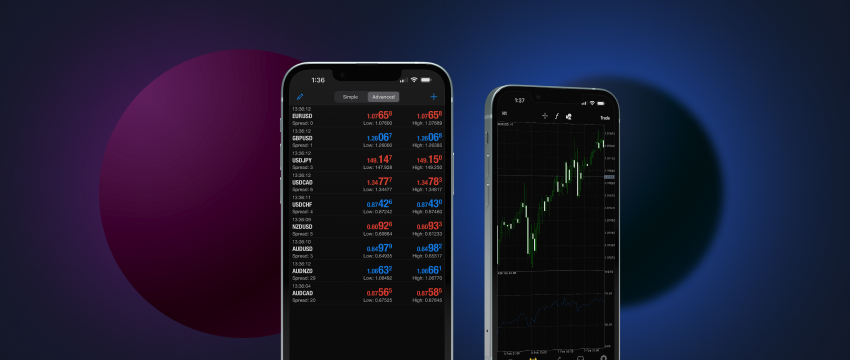

The Polish economy operates stably, but depends heavily on European and global market connections. Erupting geopolitical tensions result in fundamental changes to investor willingness to take risks. Market participants tend to shift their investments toward risk-free securities, specifically the US dollar and gold, during moments of economic discomfort. The Polish Zloty stands as a vulnerable currency, since it belongs to the category of small emerging currencies, thus it easily falls under market variations. The currency experiences substantial price shifts, which presents both risks and trade opportunities for traders. The currency trading of Zloty and additional currencies, concerning geopolitical events, depends crucially on MetaTrader 4, as well as other platforms. Real-time data, through customizable charts, enables traders to identify changes which global events trigger in their positions, so they can modify their trading methods.

Geopolitical shifts are particularly significant for Poland, due to its strategic position near the Russian-Ukrainian tensions. The Ukrainian conflict generates enlarged consequences throughout European economic zones, which Poland experiences through multiple economic consequences, because of its adjacency to Ukraine. The Zloty has become more unstable, as market sentiment changed and political uncertainties intensified in the market. All trading decisions made by Polish traders require real-time agility, as market volatility demands frequent strategy modifications. Expert Advisors on MetaTrader 4 platform enable automatic trading when users set parameters for market reactions. The automated system helps traders reduce mistakes and make necessary market position adjustments at any time, even outside normal trading sessions.

War developments in Ukraine, together with commercial ties between Poland and Russia, Belarus, along with the European Union, directly shape the Zloty currency value. General economic and trade restrictions, along with foreign policy tensions, create currency value fluctuations within the Polish economy. Polish traders need to stay informed about current political happenings, at the same level of importance as they need technical analysis knowledge. Users can establish notification systems on MetaTrader 4 that pair with news networks, delivering real-time details about geopolitical changes that shape market choices. Efficient charting features within MetaTrader 4 enable traders to detect price movements linked to geopolitical events, along with patterns through their analysis, which establishes their advantage for creating well-informed trading execution.

Polish traders need to organize themselves to face both immediate and sustained impacts that result from the potentially rising or decreasing geopolitical tensions. Traders exhibit two distinct strategies, through short-term profits or extended period momentum detection. The rapid response capability against unexpected market movements functions as a vital benefit of choosing MetaTrader 4. Polish traders profit from MetaTrader 4 because it offers a complete collection of technical indicators and provides real-time price data that enables them to excel during market periods of volatility.

The present global political tensions directly influence both currency rates and business transactions in Poland. The traders operating in Poland must maintain strong awareness of market updates, because they need immediate flexibility to modify their trading methods. Traders obtain essential functions on MetaTrader 4 that allow them to swiftly adapt their positions to risky market situations, thus securing investment outcomes. The Zloty’s reaction to geopolitical crises, together with market trend identification, becomes possible through these powerful tools, which Polish traders use to make their decisions.